Citibank - Strategizing the digital platform design direction

Role & Responsibilities

• Role: Project lead / Duration: 4.5 months (2018)

• As project lead, I am responsible for giving design direction, overseeing deliverable quality, presentation and fostering communication.

Project Background

After entering China for more than 10 years, Citibank continues to be one of the top foreign banks that comes with oversea financial benefits and global professionals, however, the appeal is no longer enough to capture the interest of Chinese customers, as local banks offer competitive products, services and more importantly, mobile conveniency. Our goal is to identify and resolve the most urgent user needs that are unique to the digital environment of China and help Citibank reconnect to their customers.

Major opportunity areas:

Discover pain points and user needs - We already know that the user experience of current digital products are lower than expectation, but what are the most pressing issues that should be fixed and can potentially bring immediate improvement?

Re-evaluate value proposition - Citibank offers competitive credit card benefits and financial products, how to articulate product values and communicate with current/future customers in a memorable way?

Redesign customer engagement - How to engage and connect to customers in order to cultivate more dedicated customers?

Approach & Result

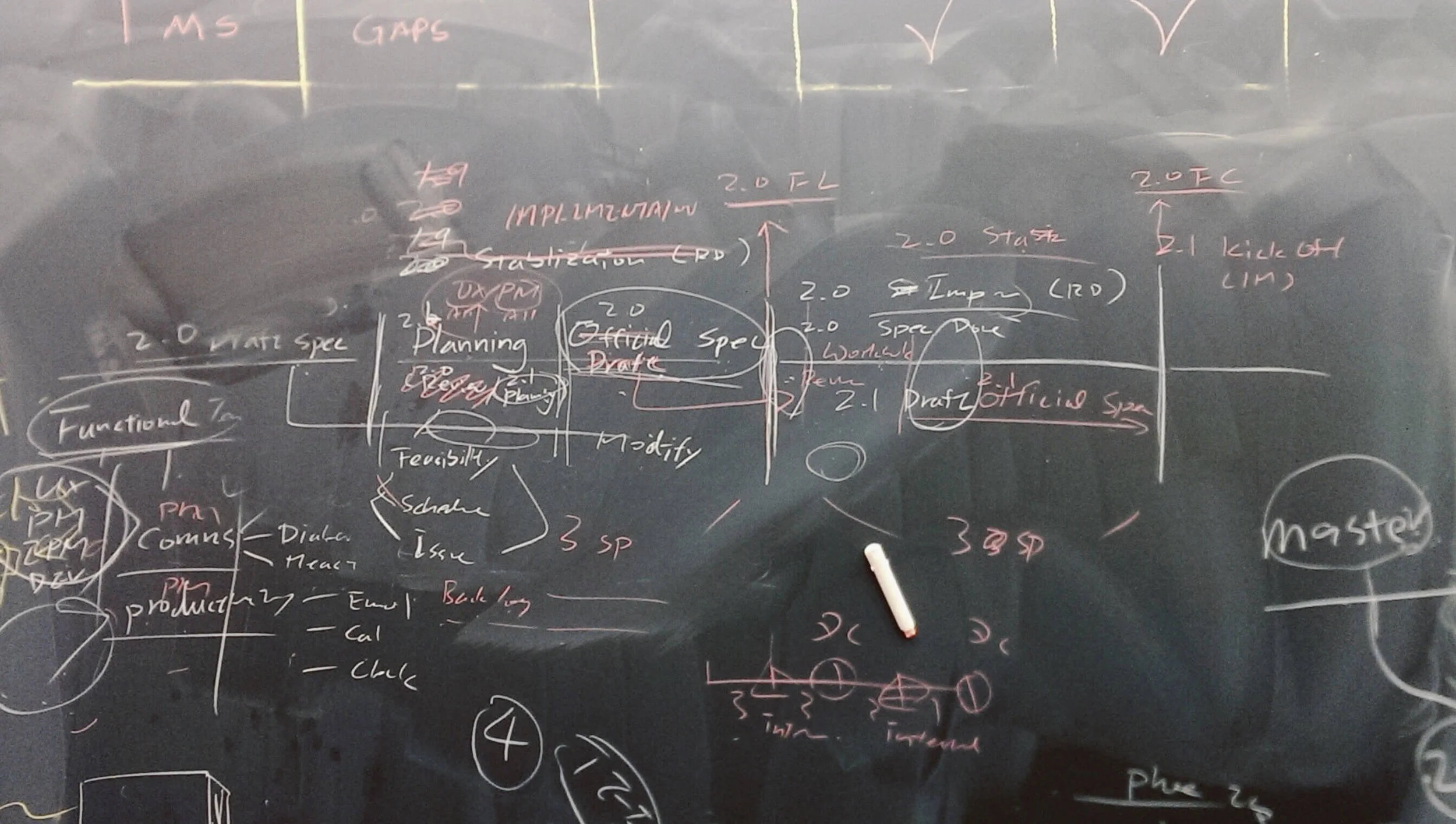

The design process can be divided into 3 phases: research, synthesis and design.

Research/Market trend, competitor analysis - Identify the key challenges Citibank is facing in the Chinese market for major business units: credit card and finance, provide advise on digital channel strategy (prioritization and key functions).

Research/User interview, user journey - Gain deep understanding on both Citibank client and front line employee.

Synthesis - Communicate unique user needs, design preferences and product expectations in China to Citibank global in order to reshape the digital experience of Citibank China.

Design - Based on research, conceptualize key visual looks.

Takeaways

What matters most in terms of digital platform design for a bank operating in China?

There are 3 key points to the design of digital platform in a finance context: security, clarity and conveniency.

There are two levels of security, actual security and perception of security. Actual security comes from a technical stand point, the steps to take in order to ensure safe transactions and inquiries, this has to translate into actual interaction. For example, how long does it take to complete an action? Is there any redundant security checks? Does the platform offer security without users having to memorize too much information? Perception of security is built on a smooth user journey and sufficient visual/textual cues, users has to be clear about what is happening right now and receive feedback of successful/unsuccessful actions.

Clarity is crucial as the amount and types of information on a bank app is enormous, keeping users informed so they can get around without hesitation. Know what the pillar services are and layout the entry points accordingly; know the connection between different services and lay it out on the user journey to enhance service experience; make clear explanation handy when it comes to important numbers.

To this day, the above two principles are considered minimum requirement in China, most of the banking app designs you see are identical, as the layout and functionality are becoming standardized, there is little room for interaction and visual design innovation, after all, in a financial context, efficiency is required, and familiarity makes sure of it.

From a designer’s standpoint, conveniency is the most interesting aspect among the three, making it intuitively convenient for users means being proactive without being intrusive. This demands a lot of thinking and workaround. For example, are services available on mobile environment whenever it is needed and some services may be partially working when offline? Is there an experience consistency across different platforms so that user doesn’t have to choose? Can an online service help speed up offline service or potentially save users the trip to visit an offline bank? There are many design opportunities to explore, this is also the area where every bank is trying to innovate and stand out, which calls for stakeholders to smartly strategize the design direction and consider priority of resource allocation.

Work done @ ARK Innovation Consulting / 2018